Apply now for fast pre-approval

Give us a call and let's have a chat.

Mortgage Brokers Point Cook

Making loans simple - our services are 100% free.

Trusted Mortgage Broker in Point Cook

Whether you're a first home buyer, an experienced investor building your property portfolio, or looking to improve your current lending situation, Point Cook Mortgage Brokers is here to help you secure the best home loan for your needs.

As trusted mortgage brokers in Point Cook, we work with a wide range of lenders to help you find the most competitive loan options — from first home buyer loans to investment property loans. Our goal is to make the entire process simple, stress-free, and tailored to your financial goals.

Many Australians lose thousands through poor loan choices or lack of knowledge — we’re here to change that. We guide you through every step of the mortgage journey, ensuring you fully understand your options, while we handle all the paperwork and negotiations behind the scenes.

The best part? We don’t charge you a fee for our service. We’re paid directly by the lender you choose, and we receive the same rate regardless of which lender you go with — so you can trust that our recommendations are 100% in your best interest.

We help clients all over Melbourne find smarter mortgage solutions with access to exclusive rates, negotiated through our lending channels. Whether you're buying your dream home, consolidating debt, or growing your investment portfolio, speak to a local mortgage expert in Point Cook who can help you save time, money, and stress.

Are you..

Your Point Cook mortgage broker

Your Point Cook Mortgage Broker

At Point Cook Mortgage Brokers, we’ve proudly served clients across Point Cook and Melbourne’s western suburbs for several years. As a small, boutique mortgage broking service, we focus on delivering a genuine, personalised experience tailored to your needs.

We understand that convenience matters — that’s why we’re always happy to come to you for in-person appointments at a time that suits you. It’s this level of flexibility and commitment that sets us apart, and it’s why our clients continue to trust us for expert guidance and outstanding customer service.

Our Happy Clients!

Trustindex verifies that the original source of the review is Google. Dennis was excellent throughout the whole home buying process. Attentive and professional in every aspect. I highly recommend Point Cook Mortgage Brokers especially if you are new to the buyers market.Trustindex verifies that the original source of the review is Google. Dennis is very helpful and took the effort to explain everything I need to know. I find him very approachable and friendly to deal with. He knows the products well and I would recommend him to anyone who needs refinancing.Trustindex verifies that the original source of the review is Google. Really great to work with Dennis for our first ever home loan. Being rookies we were a little clueless but Dennis made every step clear and as painless and possible. We hope to expand our property portfolio and will be using Dennis for our future endeavours!Trustindex verifies that the original source of the review is Google. The service and expertise Dennis and his team provided when buying my new car was fantastic, he made the process easy for me to understand I would highly recommend her services to anyone."Trustindex verifies that the original source of the review is Google. Dennis has provided us with timely response to all our questions in regards to obtaining construction loan for our house. He has always been very efficient, helpful and polite.Trustindex verifies that the original source of the review is Google. Great customer service! I highly recommend. Thank you

Why Use A Mortgage Broker?

Simple — we do all the work for you. As your local mortgage broker in Point Cook, we offer expert advice, compare dozens of lenders, and handle the entire application process on your behalf. You won’t need to do any research — we’ve got the systems and experience to help you find the most competitive mortgage that fits your financial goals.

Best of all? Our service is completely free. So really — what have you got to lose?

With hundreds of home loan products on the market — constantly changing due to interest rates and lender policies — choosing the right option can feel overwhelming. That’s where we come in. Our job as your dedicated mortgage broker is to first understand your financial situation and long-term goals. Then, we’ll recommend the right loan product that delivers value and supports your strategy.

From loan pre-approval to settlement, our end-to-end service means you won’t have to lift a finger. We’ll manage everything — saving you time, stress, and money.

We eliminate the guesswork when it comes to choosing the right lender and loan structure. Plus, we often have access to exclusive interest rates not available directly to the public. You’ll always know exactly what you're signing up for — we’ll clearly explain every part of your loan in plain English.

If you want friendly, personalised service backed by expert knowledge — look no further.

Your personalised Mortgage Broker service in Point Cook.

As your trusted mortgage broker in Point Cook, we provide expert home loan advice and access to some of the most competitive rates on the market. From start to finish, we handle the entire process — so you don’t have to worry about a thing.

We take the time to understand your unique financial situation and deliver a tailored loan solution that aligns with your goals. One of the biggest mistakes people make is only speaking to their existing bank — without knowing that better loan options may be available from other lenders that offer far more value.

Whether you’re looking for a home loan or an investment loan, we’re committed to helping you save money and make smarter financial decisions. Our service doesn’t end with the paperwork — we’re with you every step of the way, ensuring clarity, support, and results.

First Home Loan Deposit Scheme

The race is on! The federal government’s First Home Loan Deposit Scheme (FHLDS) has relaunched as of 1 July 2020 — and spots are limited. Eligible first home buyers can save up to $10,000 by avoiding Lender’s Mortgage Insurance (LMI).

Under the scheme, you only need a 5% deposit to purchase your first home — without paying for LMI. That’s a major saving for eligible buyers, but there are only 10,000 places available nationwide this financial year.

What Is the First Home Loan Deposit Scheme?

Normally, if you have less than a 20% deposit, lenders require you to pay for LMI — which can cost thousands. But with the First Home Loan Deposit Scheme, the government acts as a guarantor for your loan, meaning you can buy a home with just 5% down and no LMI, if eligible.

At Point Cook Mortgage Brokers, we help first home buyers understand the eligibility criteria and secure their place in the scheme before it’s too late.

Thinking about buying your first home? Contact our team today to check your eligibility for the First Home Loan Deposit Scheme and find the best home loan options available.

With high demand and only 10,000 spots available, the sooner you act, the better. Applications are already open — don’t miss out!

Buying your first ever home?

We'll show you how you can purchase your very first home with as little as a 5% deposit.

Why Choose Us?

When you work with Point Cook Mortgage Brokers, you receive premium service and access to a wide range of loan options tailored to your goals. We stay up to date with the latest lending strategies and market conditions, ensuring we recommend the most competitive and valuable loan currently available to you.

And we don’t stop there. If a better solution becomes available in the next 12 to 24 months, we’ll proactively reach out with new recommendations — helping you take full advantage of every opportunity in an ever-changing market.

We pride ourselves on being open, honest, and relationship-driven. Our goal is to find the right loan for you and your family — not just the easiest option. That’s why we take the time to understand your situation, provide personalised support, and work closely with you throughout the entire journey.

With 24/7 availability, we’re here whenever you need us — whether you’ve got questions, need guidance, or just want to talk through your options. You’re never just a number with us.

Always on Time

We'll get your application processed super quickly.

Hard Working

We're entirely committed to our clients.

24/7 Availability

We're always here to help.

You don’t need to ask yourself “Who is the best mortgage broker near me” anymore.

At Point Cook Mortgage Brokers, we pride ourselves on being reliable, honest, and highly experienced. Our goal is to be your go-to partner for everything related to home loans and financial services, making the process seamless from start to finish.

We’re here to take care of everything on your behalf, while keeping your long-term financial goals in focus. When you work with us, you’re supported by a dedicated broker who will walk beside you every step of the way — now, and into the future.

We offer a full range of financial services

Relocation loans

Refinance your Home Loan

Thinking about refinancing your current home loan? At Point Cook Mortgage Brokers, we help homeowners explore better options by reviewing your existing loan and comparing it against the most competitive rates available. Whether you’re looking to reduce your interest rate, access equity for renovations, or switch lenders for better features, we’ll guide you through the process from start to finish.

Our refinancing strategy is built entirely around your goals. We’ll assess your current loan structure, evaluate alternatives, and negotiate with lenders on your behalf — all at no cost to you. Let us help you unlock real savings and make your home loan work harder for you.

Reasons to Refinance

Our refinancing team in Point Cook makes the entire process stress-free and straightforward. Using smart systems and direct connections with lenders, we can process your refinance application quickly and efficiently, saving you time and hassle.

Through our lending network, we compare your current home loan with the latest offers on the market. We’ll only recommend refinancing if it results in a clear financial benefit — whether that’s a lower interest rate, better features, or a loan structure that suits your long-term goals.

Refinancing also gives you the opportunity to consolidate outstanding debts — including personal loans and credit card balances — into your mortgage. This means one manageable repayment, often at a lower interest rate, helping you reduce financial stress and take control of your cash flow.

Refinancing also gives you the opportunity to consolidate outstanding debts — including personal loans and credit card balances — into your mortgage. This means one manageable repayment, often at a lower interest rate, helping you reduce financial stress and take control of your cash flow.

Give us a call today.

Let’s have a chat to see how we can help you best.

We like to keep things simple.

Our process works as follows:

1. Call Us or Fill Out the Quote Form

The first step is easy — get in touch with our Point Cook mortgage experts via phone or our online quote form. We’ll have a personalised chat to understand your current financial situation, goals, and challenges.

Our approach is 100% tailored to you. We ask the right questions to help you uncover the best home loan strategy that aligns with your long-term goals. We know everyone’s situation is different — and that’s exactly why our advice is always custom-fit.

We also believe in educating our clients. We’ll walk you through how the process works, explain the current financial landscape, and break down the pros and cons of different loan types — whether that’s the difference between interest-only and principal and interest loans, or how interest rates impact your repayments.

Our goal is to empower you with knowledge, so you feel confident and in control of your financial decisions from day one.

2. Arrange a Pre-Approved Loan

Once we’ve fully understood your financial goals and personal circumstances, we’ll create a custom loan strategy that aligns with your objectives — whether you're buying your first home or expanding your investment portfolio.

One of the first steps we recommend is securing a home loan pre-approval. This gives you confidence and clarity around your budget, allowing you to make offers quickly when you find the right property. Pre-approval is a smart move — and the process is fast, simple, and stress-free with our help.

We’ll provide you with a full breakdown of what’s involved — including interest rates, monthly repayment estimates, and available loan packages. We’ll explain the difference between fixed vs variable loans, what packaged home loans include, and how these compare with basic options.

If you're a property investor looking to scale, we’ll guide you through lender selection — including the pros and cons of major banks vs smaller lenders. Some lenders may offer a low rate upfront but limit your borrowing power later. That’s why we go beyond just chasing the lowest interest rate — we help you think long term.

With our expert advice, you’ll make informed decisions about the lender that will support your goals now and in the future.

3. Loan Approval, Settlement & Ongoing Support

Once we’ve received all your documentation, we’ll handle the next steps — working directly with the bank to get your home loan approved and settled smoothly. We’ll keep you updated throughout the process so you can relax while we take care of everything. In most cases, settlement is completed within 1–2 weeks.

But our service doesn’t stop once your loan is approved. At Mortgage Brokers Point Cook, we continue to support you long after settlement — answering any questions and guiding you through the life of your loan.

Each year, we’ll proactively review your home loan to ensure you’re still on the best possible rate and package. If better options are available, we’ll negotiate with your current lender or help you refinance with another lender — but only if it clearly puts you in a stronger financial position.

With us, you’re not just getting a loan — you’re gaining a long-term partner committed to your financial success.

Home loans

At Point Cook Mortgage Brokers, we specialise in helping clients secure the right home loan in Point Cook — with expert support every step of the way. We understand that purchasing a property can feel overwhelming, especially for first home buyers. From selecting the right loan to managing paperwork, the process can be stressful without the right guidance.

That’s where we come in. We begin by assessing your financial goals and current position to recommend a home loan package that delivers real value. We’ll also help you secure a pre-approval — giving you confidence when making offers and negotiating property purchases.

From loan application to approval and settlement, our team manages the entire process on your behalf, providing regular updates so you’re always in the loop.

If you’re a first home buyer, we can assist with the First Home Owner Grant and the First Home Loan Deposit Scheme (FHLDS), guiding you through eligibility and helping you make the most of every available benefit.

Investment loans

If you’re searching for the right investment property loan in Point Cook, we’ll help you secure the best possible deal from our panel of trusted lenders. Our team at Point Cook Mortgage Brokers will recommend a loan structure tailored to your strategy — whether it’s interest-only or principal and interest — while working to minimise Lender’s Mortgage Insurance (LMI) and maximise your long-term returns.

We’ll also conduct a full review of your existing property portfolio to ensure you’re getting the most out of your finance strategy. That means identifying better interest rates, renegotiating terms with your current lender, or helping you switch to a more competitive product where appropriate.

Our service includes managing important milestones like property valuations, loan documentation, and settlement timelines. We handle everything for you — on your schedule — so you can focus on growing your investments.

And the best part? We do all of this at absolutely no cost to you. That’s the value of working with a mortgage broker who puts your goals first.

Renovation loans

We understand that home renovations can be costly — especially when major structural work is required. These projects often demand significant capital, and without the right funding strategy, they can place pressure on your cash flow and other financial commitments.

At Point Cook Mortgage Brokers, we help homeowners explore smart ways to fund their renovations. Whether it’s through a dedicated renovation loan or by leveraging available equity in your current property, we’ll recommend a solution that balances flexibility, affordability, and long-term value.

From understanding your borrowing power to structuring the loan around your goals, we’ll guide you every step of the way to ensure your renovation plans are financially achievable.

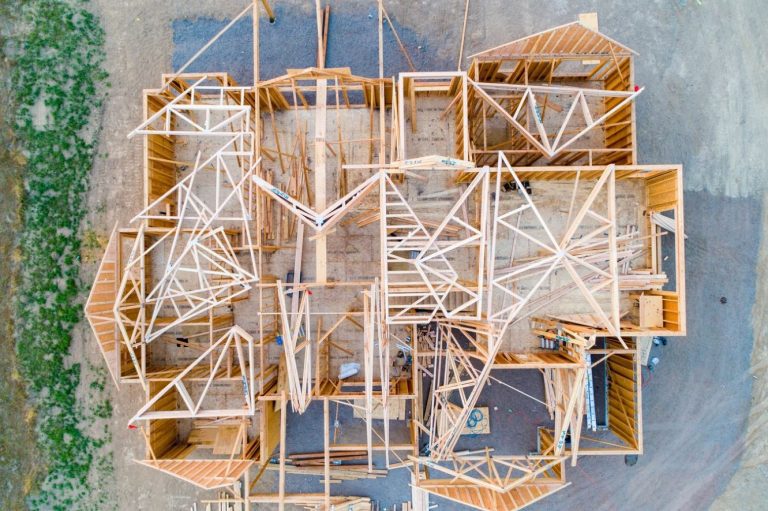

Construction loans

Planning to build your dream home or investment property? At Point Cook Mortgage Brokers, we help clients secure the right construction loan to support their building journey — from the first slab to final handover. Construction finance can feel complex, but with our expert guidance, it doesn’t have to be.

A construction loan offers flexibility that standard home loans don’t. Funds are released in stages — known as progressive drawdowns — which means you only draw down the amount needed at each phase of the build. This structure allows you to only pay interest on the portion you’ve used, helping to manage your cash flow more efficiently throughout the project.

We’ll help you understand how construction loans work, liaise with your builder and lender, and ensure you’re set up with the best loan structure for your financial goals and timeline.

Commercial loans

At Point Cook Mortgage Brokers, we help business owners secure the right commercial loan in Point Cook to fund their next venture. Whether you’re looking for short-term working capital or long-term finance for a new project, our experienced brokers can tailor a lending solution that aligns with your business strategy.

With access to a wide panel of lenders and commercial funding institutions, we source competitive business loan options to suit a range of industries and commercial goals. From property development to asset acquisition, we’ll guide you through every step — negotiating terms, managing documentation, and ensuring the funding is structured for long-term value.

If you’re ready to take your business to the next level, our team can help you access the capital you need — efficiently and with confidence.

Car loans

Purchasing your dream vehicle doesn’t have to drain your savings. At Point Cook Mortgage Brokers, we make it easy to access the right car loan in Point Cook, so you can enjoy your new vehicle while managing your cash flow effectively.

We’ll match you with a trusted lender offering flexible repayment terms and competitive rates — allowing you to spread out the cost of your car and budget with confidence. Whether it’s for a personal vehicle or a work car, we’ll tailor a finance solution that works for you.

Our team takes care of the entire process — from lender comparison to loan approval — so you can focus on getting behind the wheel of the car you’ve always wanted, without the financial stress.

Not located in the Point Cook? No worries - we can serve anyone nationally with ease.

We service all areas of Point Cook.

Sunbury

Sunshine

Tarneit

Taylors Lakes

Truganina

Werribee

Williamstown

Yarraville

Approved Point Cook Mortgage Brokerage Service

Let our experienced Mortgage Brokers in Point Cook handle all the heavy lifting for you. We deliver a complete, end-to-end solution — from initial consultation to settlement — helping you secure the right loan product to support your long-term financial goals. Our approach is centred on understanding your needs and building a personalised strategy that delivers value at every stage.

At Point Cook Mortgage Brokers, we’re committed to more than just getting your loan approved. We’re here to educate, support, and guide you throughout the journey. With years of experience, we tailor lending strategies unique to your financial circumstances, ensuring every element aligns with your goals.

Our service doesn’t stop at approval. We stay in touch to review your loan over time and reconnect when new opportunities arise — whether that means renegotiating with your lender or exploring better deals on the market. Our ongoing support ensures your loan always works as hard as you do.

With access to an extensive panel of lenders and the most competitive rates available, we handle everything — including the paperwork — with speed and precision. It’s our mission to take the stress out of the mortgage process, so you can focus on what matters most.

We act on your behalf, managing every detail of your loan from start to finish, so you can enjoy peace of mind and a completely stress-free lending experience.

Call us today.

We understand that making financial decisions can be overwhelming — but with the right guidance, it doesn’t have to be. At Point Cook Mortgage Brokers, our mission is to provide peace of mind by supporting you through every step of your lending journey and delivering the best financial outcomes possible.

Our Mortgage Brokers in Point Cook are here to listen, advise, and act on your behalf — ensuring you receive exceptional customer service, tailored solutions, and a stress-free experience from start to finish.

We believe in being open, honest, and proactive. That means keeping you informed, explaining your options in plain language, and making sure you feel confident and cared for at every stage of the process.

Call us today or book a consultation — and let’s find the right financial solution for you.